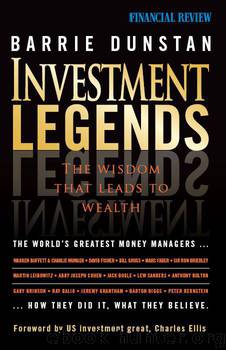

Investment Legends: The Wisdom that Leads to Wealth (Financial Review) by Barrie Dunstan

Author:Barrie Dunstan [Dunstan, Barrie]

Language: eng

Format: mobi

Publisher: Wiley

Published: 2012-01-23T14:00:00+00:00

And finally, she says, there’s the question of whether the borrowers themselves had some culpability. It seems some people bought properties that they couldn’t afford and took advantage of lending terms that were literally too good to be true. Certainly, there were some low- and middle-income families with subprime loans, taking advantage of their no down payment and so-called ‘teaser’ low initial interest rates. (Remember, she says, subprime usually refers to the lack of a deposit or down payment and not necessarily the creditworthiness of the borrower.)

Cohen says she will be very interested to see what percentage of the ultimate defaults and foreclosures are by borrowers not in that category, but buyers who were making a calculated decision and were perhaps anxious to buy multiple residences, likely for investment purposes. For example, in the sun-belt areas of the US, in states such as Arizona and Florida, ‘flipping’ condominiums was a common practice in which the buyer never intended to live in the residence. With some of these projects nearing completion, she says developers have been reporting that some buyers are seeking to step away from deals because they had no down payments.

Even the downdraft in the US dollar hasn’t fazed Cohen. As American policy appears to let the currency take much of the adjustment, Cohen minimises the effect on the psyche of Americans, although not the economy. ‘Number one: most American citizens don’t think much about the dollar.’ Unlike many other countries, the value of the US currency is not typically a matter of national pride, she says. ‘If you asked someone in the street how the US dollar was priced today, most wouldn’t know. If citizens don’t care, most politicians don’t care either.’

‘Point number two: we are benefiting from a weak dollar, at least at this time. The normal effects of a weak currency, such as rising prices, are not happening here yet.’ Instead, there have been some positive benefits — a significant inflow of foreign direct investment by companies using their own ‘rich’ currencies to buy US operating assets, plus significant portfolio flows into equities and real estate. Also, most importantly, US exports are extremely competitive. Export growth is 8 percent and during the past year the US trade deficit has been getting smaller, even with the rise in energy prices.’

The weak dollar could become a problem ‘if non-American investors went on a buyer’s strike of US Treasury securities. That is not the case [now]. There is still strong demand for US Treasuries and we see is that even on days of significant market turmoil, there is often foreign significant buying of US Treasuries.’ At some point, it will matter, she says, but at least for now the weak currency is not creating significant problems.

As for geopolitical fears, Cohen notes that she and her colleagues assume that the US markets are at, and will stay at, an elevated level of risk concern. This can be factored into valuation models by assuming that investors will insist on a ‘risk premium’ or extra returns from holding certain securities.

Download

This site does not store any files on its server. We only index and link to content provided by other sites. Please contact the content providers to delete copyright contents if any and email us, we'll remove relevant links or contents immediately.

The Black Swan by Nassim Nicholas Taleb(7129)

Bad Blood by John Carreyrou(6621)

Pioneering Portfolio Management by David F. Swensen(6300)

Millionaire: The Philanderer, Gambler, and Duelist Who Invented Modern Finance by Janet Gleeson(4478)

Skin in the Game by Nassim Nicholas Taleb(4248)

The Money Culture by Michael Lewis(4207)

Bullshit Jobs by David Graeber(4190)

Skin in the Game: Hidden Asymmetries in Daily Life by Nassim Nicholas Taleb(4006)

The Wisdom of Finance by Mihir Desai(3747)

Blockchain Basics by Daniel Drescher(3582)

Liar's Poker by Michael Lewis(3449)

Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets by Nassim Nicholas Taleb(3124)

Hands-On Machine Learning for Algorithmic Trading by Stefan Jansen(3072)

Mastering Bitcoin: Programming the Open Blockchain by Andreas M. Antonopoulos(3045)

The Intelligent Investor by Benjamin Graham Jason Zweig(3041)

The Power of Broke by Daymond John(2988)

Investing For Dummies by Eric Tyson(2954)

You Are What You Risk by Michele Wucker(2835)

Bull by the Horns: Fighting to Save Main Street From Wall Street and Wall Street From Itself by Sheila Bair(2771)